UNITED STATES

|

| | | | | |

| UNITED STATES |

| SECURITIES AND EXCHANGE COMMISSION |

Washington, D.C. 20549 |

SCHEDULE 14A |

SCHEDULE 14A

|

|

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. ) |

|

Filed by the Registrant x |

|

Filed by a Party other than the Registranto |

|

Check the appropriate box: |

o | | Preliminary Proxy Statement |

o |

| Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

x

ý | | Definitive Proxy Statement |

o | | Definitive Additional Materials |

o | | Soliciting Material Pursuant to §240.14a-12 |

|

VITESSE SEMICONDUCTOR CORPORATION |

(Name of Registrant as Specified In Its Charter) |

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment of Filing Fee (Check the appropriate box): |

x

ý | | No fee required. |

o | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1)

| (1 | ) | | Title of each class of securities to which transaction applies: |

| | |

| (2 | (2)

) | | Aggregate number of securities to which transaction applies: |

| | |

| (3 | (3)

) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| (4 | (4)

) | | Proposed maximum aggregate value of transaction: |

| | |

| (5 | (5)

) | | Total fee paid: |

| o | | |

o

| Fee paid previously with preliminary materials. |

o | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1)

| (1 | ) | | Amount Previously Paid: |

| | |

| (2 | (2)

) | | Form, Schedule or Registration Statement No.: |

| | (3 | ) | | Filing Party: |

| (3)

| Filing Party:

|

| (4 | ) | |

| (4)

| Date Filed: |

| | |

| | | |

741

4721 Calle

Plano DriveCarga

Camarillo, California 93012

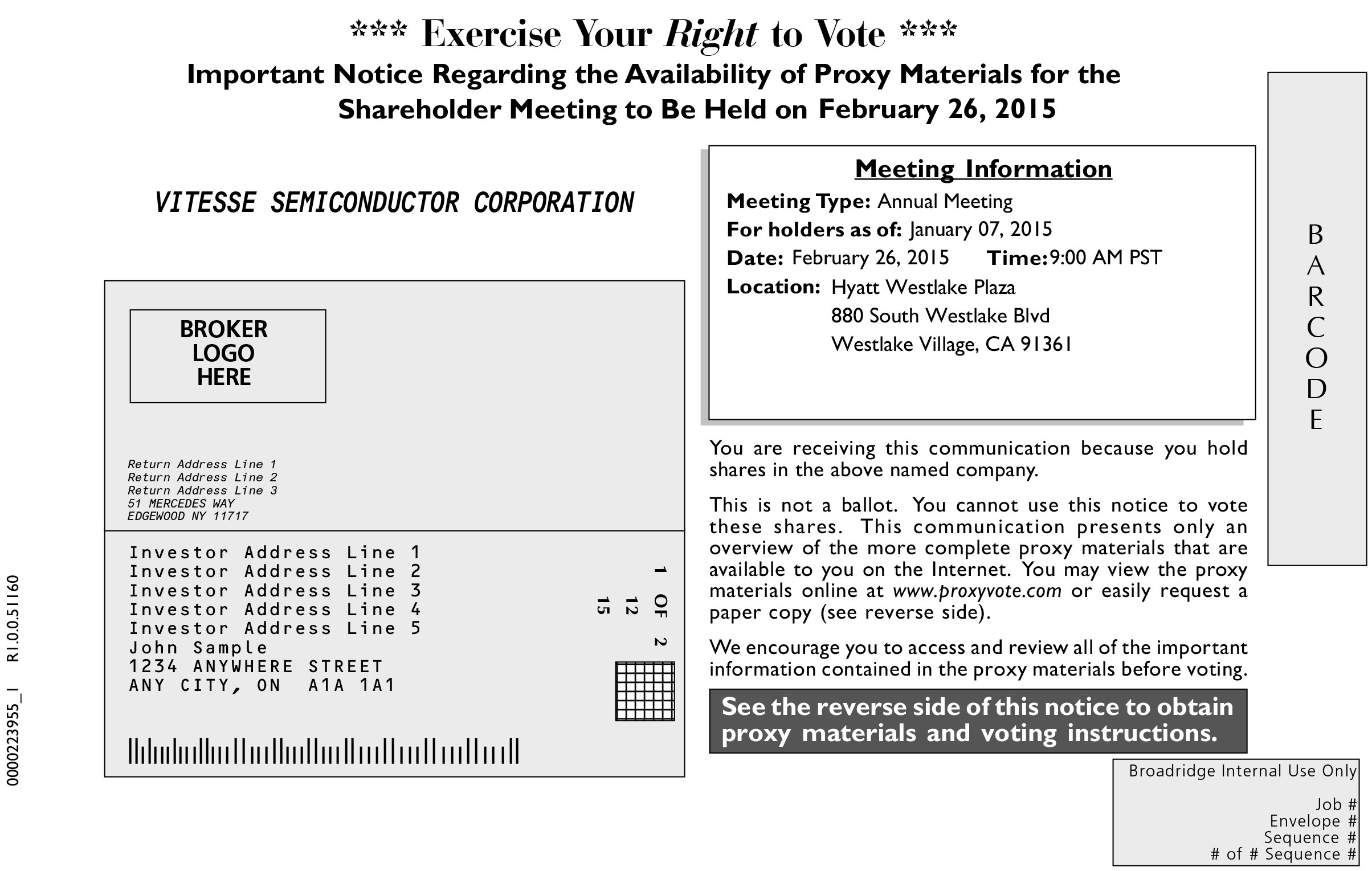

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held Thursday, JanuaryFebruary 26, 20122015

The

20122015 Annual Meeting of Stockholders of Vitesse Semiconductor Corporation will be held on

JanuaryFebruary 26,

2012,2015, at 9:00 a.m. local time, at the Hyatt Westlake Plaza in Thousand Oaks, 880

SouthS. Westlake Boulevard, Westlake Village,

CACalifornia 91361, for the following purposes:

1. To elect six directors to hold office for the ensuing year and until their successors are duly elected;

2. To hold an advisory vote on executive compensation;

3. To hold an advisory vote on the frequency of the advisory vote on executive compensation;

4. To ratify the selection of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2012; and

5. To transact such other business as may properly be brought before the meeting and any adjournment(s) thereof.

| |

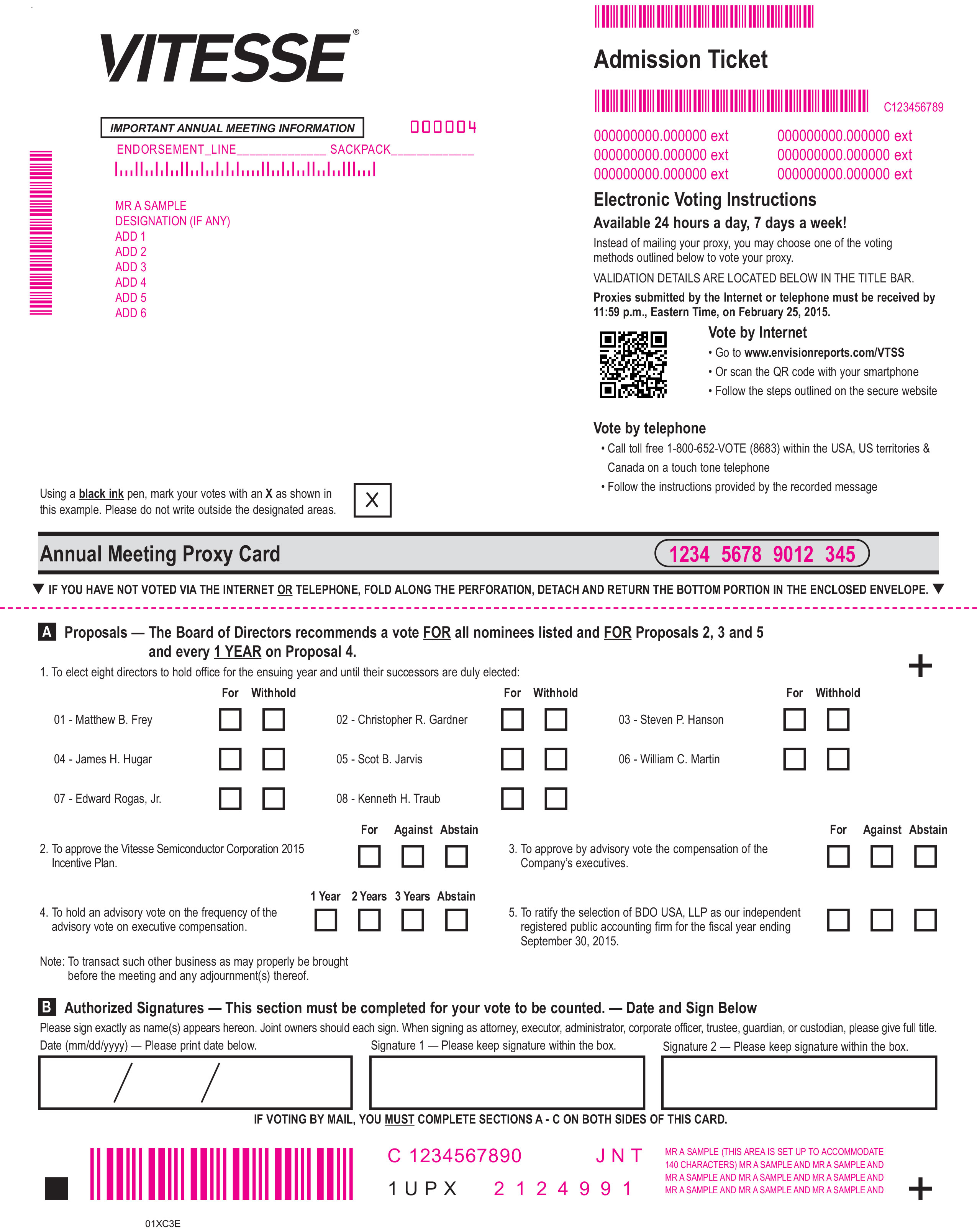

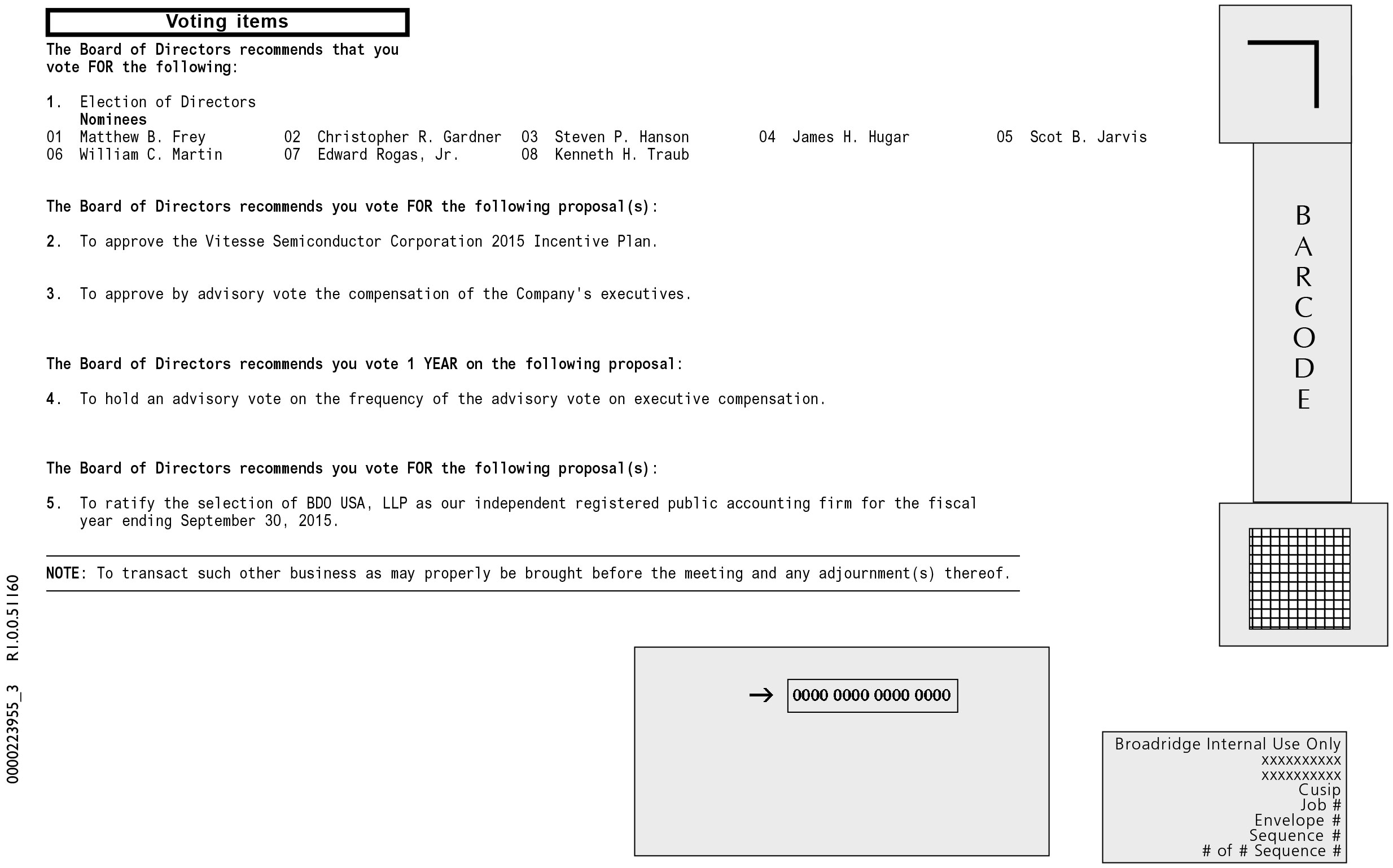

| 1. | To elect eight directors to hold office for the ensuing year and until their successors are duly elected; |

| |

| 2. | To approve the Vitesse Semiconductor Corporation 2015 Incentive Plan; |

| |

| 3. | To hold an advisory vote on executive compensation; |

| |

| 4. | To hold an advisory vote on the frequency of the advisory vote on executive compensation; |

| |

| 5. | To ratify the selection of BDO USA, LLP as our independent registered public accounting firm for the fiscal year ending September 30, 2015; and |

| |

| 6. | To transact such other business as may properly be brought before the meeting and any adjournment(s) thereof. |

The foregoing items of business are more fully described in the proxy statement accompanying this Notice. Stockholders of record at the close of business on

December 5, 2011January 7, 2015 are entitled to notice of, and to vote at, the Annual Meeting.

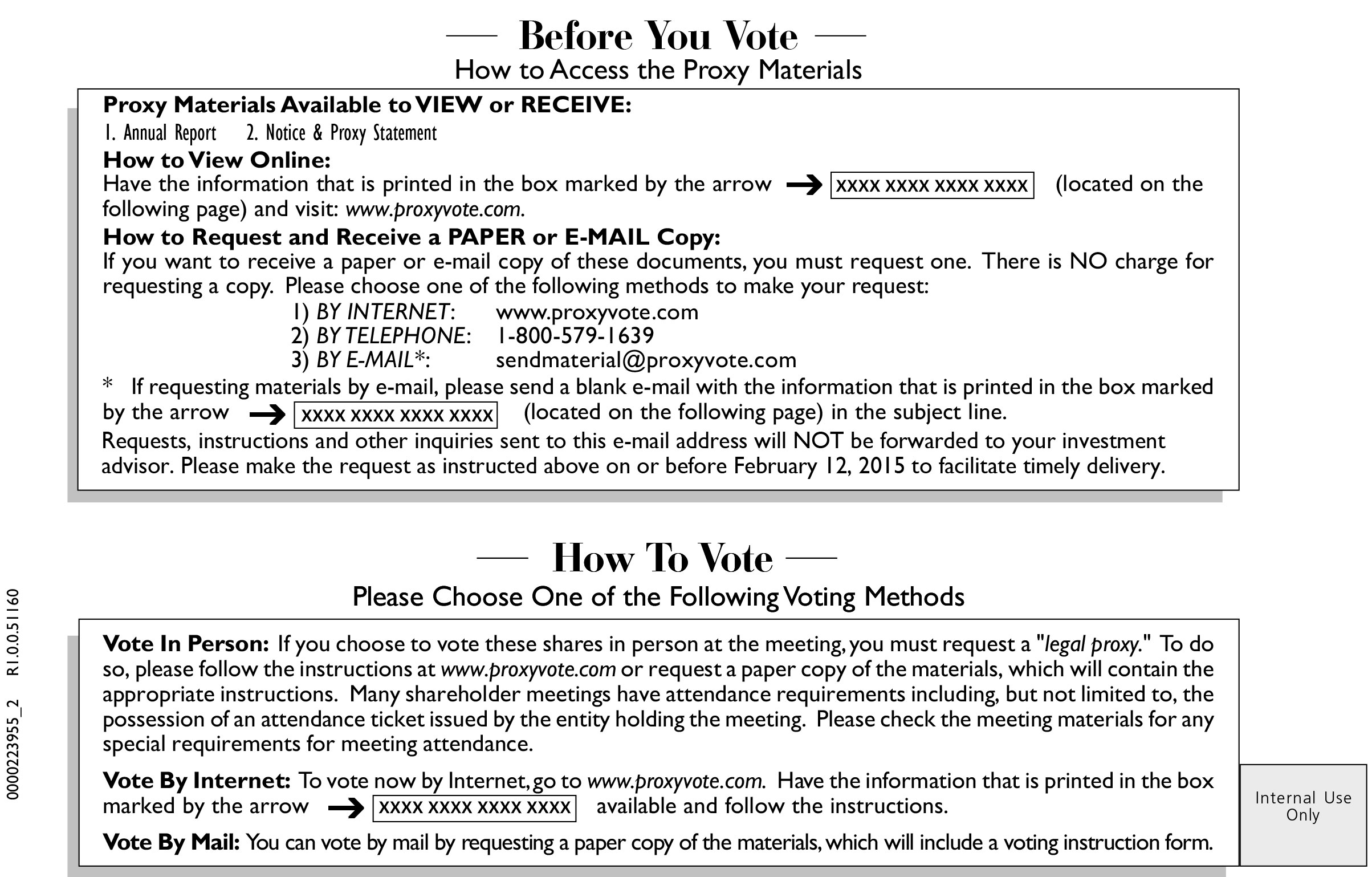

All stockholders are cordially invited to attend the meeting. This year, we are using the Internet as our primary means of furnishing proxy materials to our stockholders. Accordingly, most stockholders will not receive paper copies of our proxy materials. We will instead send our stockholders a notice with instructions for accessing the proxy materials and voting electronically over the Internet or by telephone. The notice also provides information on how stockholders may request paper copies of our proxy materials. You may access the proxy statement and our annual report on the Internet, both of which are available at

“www.edocumentview.com/VTSS.”“www.envisionreports.com/VTSS”.

Your vote is important. Whether or not you plan to attend the Annual Meeting, it is important that your shares be represented and voted at the meeting and we urge you to vote as soon as possible. As an alternative to voting in person at the Annual Meeting, you may vote electronically over the Internet or by telephone, or if you receive a proxy card or voting instruction form in the mail, by mailing the completed proxy card or voting instruction form. Timely voting by any of these methods will ensure your representation at the Annual Meeting.

|

| |

| By Order of the Board of Directors, |

| |

|

|

Camarillo, California | Christopher R. Gardner |

December 6, 2011

January 7, 2015 | President and Chief Executive Officer |

VITESSE SEMICONDUCTOR CORPORATION

741

4721 Calle Plano Drive

Carga

Camarillo, California 93012

(805) 388-3700

INFORMATION CONCERNING SOLICITATION AND VOTING

The enclosed proxy is solicited on behalf of the Board of Directors (the “Board”) of Vitesse Semiconductor Corporation (“Vitesse” or the “Company”, “us”, “we”, or “our”) for use at the

20122015 Annual Meeting of Stockholders (the “Annual Meeting”) to be held at the Hyatt Westlake Plaza in Thousand Oaks, 880

SouthS. Westlake Boulevard, Westlake Village,

CACalifornia 91361, on Thursday,

JanuaryFebruary 26,

2012,2015, at 9:00 a.m. local time and at any adjournment(s) thereof, for the purposes set forth herein and in the accompanying Notice of Annual Meeting of Stockholders. This Proxy Statement is first being made available to all stockholders entitled to vote at the Annual Meeting on or about

December 16, 2011.January 15, 2015.

Record Date and Shares Outstanding

Stockholders of record at the close of business on

December 5, 2011January 7, 2015 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting and at any adjournment(s) thereof. On the Record Date,

24,487,97868,426,192 shares of our common stock,Common Stock, $0.01 par value, were issued and outstanding.

Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use (i) by delivering to us at our principal offices (Attention: Corporate Secretary) a written notice of revocation or a duly executed proxy bearing a later date, or (ii) by attending the Annual Meeting and voting in person. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote in person at the Annual Meeting, you must obtain a proxy issued in your name from that record holder, and you will need to provide a copy of such proxy at the Annual Meeting.

Attendance at the Annual Meeting

All stockholders of record as of the Record Date may attend the Annual Meeting. Please note that cameras, recording devices and other electronic devices will not be permitted at the Annual Meeting. No items will be allowed into the Annual Meeting that might pose a concern for the safety of those attending. Additionally, to attend the meeting you will need to bring identification and proof sufficient to us that you were a stockholder of record as of the Record Date or that you are a representative of a stockholder of record as of the Record Date for a stockholder of record that is not a natural person.

For directions to attend the Annual Meeting, please visit the Hyatt Westlake Plaza

in Thousand Oaks website at

http://westlake.hyatt.com/hyatt/hotels/services/mapswww.westlake.hyatt.com/en/hotel/our-hotel/map-and-directions.html or contact the hotel via telephone at (805) 557-1234.

Voting and Costs of Solicitation

Shares Directly Held—StockholderHeld-Stockholder of RecordRecord. . If you are a “registered holder,” that is your shares are registered in your name through our transfer agent, and you are viewing this proxy over the Internet you may vote electronically over the Internet. For those stockholders who receive a paper proxy in the mail, you may also vote electronically over the Internet or by telephone or by completing and mailing the proxy card provided. The website identified in our Notice of Internet Availability of Proxy Materials provides specific instructions on how to vote electronically over the Internet. Those stockholders who receive a paper proxy by mail, and who elect to vote by mail, should complete and return the mailed proxy card in the prepaid and addressed envelope that was enclosed with the proxy materials. You may request a ballot at the Annual Meeting and vote your shares in person.

Shares Indirectly Held—Beneficial OwnerHeld-Beneficial Owner. . If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the beneficial owner of shares held in “street name,” and these proxy materials are being forwarded to you by your broker or nominee who is considered the stockholder of record with respect to those shares. We urge you to direct your broker on how to vote your shares. Beneficial owners may attend the Annual Meeting, but may not vote in person unless you obtain a signed proxy from the stockholder of record giving you the right to vote the shares in person at the Annual Meeting. Your broker or nominee should provide you with a voting instruction card for you to use in directing the broker or nominee regarding how to vote your shares. If you did not receive a voting instruction card, please contact the institution holding your shares. We recommend that you vote your shares in advance as described above, so that your vote will be counted if you later decide not to attend the Annual Meeting. Only proxy cards and voting instruction forms that have been signed, dated and timely returned, and only proxies that have been timely voted electronically or by telephone will be counted in the quorum and voted. The Internet and telephone voting facilities will close at 11:59 p.m. Eastern Time, Wednesday, JanuaryFebruary 25, 2012. 2015. Stockholders who vote over the Internet or by telephone need not return a proxy card or voting instruction form by mail. We will bear the entire cost of the solicitation of proxies for the Annual Meeting, including the preparation, assembly, printing and mailing of the Notice of Internet Availability of Proxy Materials, this proxy statement, the proxy card, and any additional solicitation materials furnished to stockholders. Solicitations also may be made by personal interview, telephone and electronic communications by directors, officers and other employees of Vitesse without additional compensation. We may reimburse brokerage firms and other persons representing beneficial owners of shares for their expenses in forwarding solicitation material to such beneficial owners. No additional compensation will be paid to those individuals for any such services.

If your proxy is properly submitted, the shares represented thereby will be voted at the Annual Meeting in accordance with your instructions. If you are a registered holder and you do not specify how the shares represented thereby are to be voted, your shares will be voted as follows:

·

“For” election of all

sixeight nominees for director as described in Proposal One;

·

“For” approval of the Vitesse Semiconductor Corporation 2015 Incentive Plan as described in Proposal Two;

“For” approval of the advisory vote on executive compensation as described in Proposal

Two;·Three;

In favor of a

say-on- paysay-on-pay vote occurring every “1 Year” as described in Proposal

Three;Four; and

·

“For” ratification of the appointment of BDO USA, LLP as our independent registered public accounting firm as described in Proposal

Four.2

Five.

If any other matters are properly presented for consideration at the Annual Meeting, including, among other things, consideration of a motion to adjourn the meeting to another time or place in order to solicit additional proxies in favor of the nominees of theour Board of Directors, the persons named as proxies and acting thereunder will have discretion to vote on these matters according to their best judgment to the same extent as the person delivering the proxy would be entitled to vote. At the date this proxy statement went to press, we did not know of any other matter to be raised at the Annual Meeting.

Some stockholders receive more than one Notice of Internet Availability of Proxy Materials, proxy card or voting instruction form because their shares are held in multiple accounts or registered in different names or addresses. Please vote your shares held in each account to ensure that all of your shares will be voted.

Quorum, Abstentions, Broker Non-Votes, Required Votes

Our bylaws provide that stockholders holding a majority of the shares of

common stockCommon Stock issued and outstanding and entitled to vote on the Record Date constitute a quorum at meetings of stockholders. Therefore, at the Annual Meeting, the presence, in person or by proxy, of the holders of at least

12,243,99034,213,097 shares of Common Stock will be required to establish a quorum. Each outstanding share of our Common Stock is entitled to one vote on each proposal at the Annual Meeting. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum. Broker non-votes, however, are not counted as shares present and entitled to be voted with respect to the matter on which the broker has expressly not voted. Thus, broker non-votes will not affect the outcome of any of the matters being voted on at the Annual Meeting. Generally, broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal because (1) the broker has not received voting instructions from the beneficial owner and (2) the broker lacks discretionary voting power to vote such shares because the matter is not considered a routine matter. The only routine matter that is being submitted to stockholders at the Annual Meeting is Proposal

Four,Five, ratification of the appointment of our independent registered public accounting firm.

In the election of the

sixeight directors (Proposal One), you may vote “For” all of the nominees or your vote may be “Withheld” with respect to one or more of the nominees.

With respect to Proposal Three, the advisory vote on the frequency of the advisory vote on executive compensation, you may vote for “1 year,” “2 years,” or “3 years” or you may “Abstain.” For all other proposals, you may vote “For,” “Against” or “Abstain.” If you “Abstain,” it has the same effect as a vote “Against.”

If a quorum is present at the Annual Meeting, a plurality of the shares voting will be sufficient to elect the director nominees (Proposal One). This means that the

sixeight nominees for election as directors who receive the most votes “for” election will be elected. Approval of the

Vitesse Semiconductor Corporation 2015 Incentive Plan (Proposal Two), approval of the advisory vote on executive compensation (Proposal

Two)Three) and ratification of the appointment of our independent registered public accounting firm (Proposal

Four)Five), each will require an affirmative vote of the majority of the shares of Common Stock present or represented at the Annual Meeting with respect to such proposal. With respect to the frequency of the advisory vote on executive compensation (Proposal

Three)Four), the Board will give careful consideration to the voting results on this proposal and expects to adopt the alternative that receives the greatest number of votes, even if that alternative does not receive a majority of the votes cast.

If by the date of the Annual Meeting we do not receive proxies representing sufficient shares to constitute a quorum, the Chairman of the Meeting, or the stockholders entitled to vote thereat, shall have power to adjourn the meeting, without notice other than announcement at the meeting, until a quorum is present or represented. At such adjourned meeting at which a quorum is present, any business may be transacted that might have been transacted at the meeting as originally noticed.

Effect of Not Casting Your Vote

If you hold your shares in street name it is critical that you cast your vote if you want it to count in the election of directors (Proposal One). In the past, if you held your shares in street name, and you did not indicate how you wanted your shares voted in the election of directors, your bank or broker was allowed to vote those shares on your behalf in the election of directors as it

feltdeemed appropriate.

3

Your bank or broker no longer has the discretion to vote your uninstructed shares in the election of directors. Similarly, your bank or broker does not have ability to vote your uninstructed shares on any other matters being submitted to the stockholders for a vote at the Annual Meeting other than ratification of the appointment of our independent registered public accounting firm (Proposal Four)Five). Thus, if you hold your shares in street name and you do not instruct your bank or broker how to vote at the Annual Meeting, your shares will not be voted on Proposals One, Two, Three, or Three.

Four.

Deadline for Receipt of Stockholder Proposals

In order for a stockholder proposal to be considered for inclusion in our proxy statement for our

20132016 Annual Meeting of Stockholders, the written proposal must be received by us no later than

August 18, 2012,September 17, 2015 and should contain the information required under our bylaws. If the date of next year’s

annual meetingAnnual Meeting is moved more than 30 days before or after

JanuaryFebruary 26,

2013,2016, the first anniversary date of this year’s Annual Meeting, the deadline for inclusion of proposals in our proxy statement is instead a reasonable time before we begin to print and mail our proxy materials for next year’s meeting. Any proposals will also need to comply with Rule 14a-8 of the rules and regulations promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), regarding the inclusion of stockholder proposals in company sponsored proxy materials. Proposals should be addressed to our Corporate Secretary, at our principal executive offices.

If you intend to present a proposal at our

20132016 Annual Meeting of Stockholders and the proposal is not intended to be included in our proxy statement relating to that meeting, you must give us advance notice of the proposal in accordance with our bylaws. Pursuant to our bylaws, in order for a stockholder proposal to be deemed properly presented in these circumstances, a stockholder must deliver notice of the proposal to our Corporate Secretary, at our principal executive offices after the close of business on

OctoberNovember 28,

20122015 and before the close of business on

November 27, 2012.December 28, 2015. However, if the date of our

20132016 Annual Meeting of Stockholders is more than 30 days before or after

JanuaryFebruary 26,

2013,2016, the first anniversary of this year’s Annual Meeting, stockholders must give us notice of any stockholder proposals within a reasonable time before the mailing date of the proxy statement for next year’s Annual Meeting. If a stockholder does not provide us with notice of a stockholder proposal in accordance with the deadlines described above, the stockholder will not be permitted to present the proposal to the stockholders for a vote at the meeting.

The proxies to be solicited by us through our Board of Directors for our

20132016 Annual Meeting of Stockholders will confer discretionary authority on the proxy holders to vote on any stockholder proposal properly presented at the

20132016 Annual Meeting of Stockholders if we fail to receive notice of the stockholder’s proposal for the meeting by

August 18, 2012.September 17, 2015.

If a stockholder desires only to recommend a candidate for consideration by the Nominating and Corporate Governance Committee as a potential nominee for

theour Board, see the procedures discussed in “Proposal

One—ElectionOne-Election of

Directors—ProcessDirectors-Process for Recommending Candidates for Election to

theour Board of Directors.”

We will provide without charge to each stockholder solicited by these proxy materials a copy of Vitesse’s annual report on Form 10-K for the fiscal year ended September 30,

2011,2014, without exhibits, and any amendments, upon request of such stockholder made in writing to Vitesse Semiconductor Corporation,

7414721 Calle

Plano Drive,Carga, Camarillo, California 93012, Attn: Investor Relations. We will also furnish any exhibit to the annual report on Form 10-K, if specifically requested in writing.

We maintain a web site, www.vitesse.com, where we regularly post copies of our press releases and other company information. You can also access our Securities and Exchange Commission (“SEC”) filings, including our annual reports on Form 10-K, on the SEC website at www.sec.gov.

Our bylaws provide that the authorized number of directors is a minimum of five and a maximum of nine, with the exact number set by our Board. Currently, the authorized number of directors of the Company is

six,eight, and

sixeight members of our Board are to be elected at the Annual Meeting. Unless otherwise instructed, the proxy holders will vote the proxies received by them for the nominees named below. Each nominee has consented to be named a nominee in this proxy statement and

to continue to serve as a director if elected. If any nominee becomes unable or declines to serve as a director, if additional persons are nominated at the meeting, or if stockholders are entitled to cumulate votes, the proxy holders intend to vote all proxies received by them in such a manner (in accordance with cumulative voting) as will ensure the election of as many of the nominees listed below as possible, and the specific nominees to be voted for will be determined by the proxy holders. We are not aware of any reason that any nominee will be unable or will decline to serve as a director. The term of office of each person elected as a director will continue until the next Annual Meeting of Stockholders, or until a successor has been elected and qualified, or until his or her earlier resignation or removal. There are no family relationships among any of our directors or executive officers. There are no arrangements or understandings between any director or executive officer and any other person pursuant to which he or she is or was to be selected as a director or officer.

The names of the nominees

all of whom are currently directors standing for re-election, and certain information about them as of December

5, 2011,31, 2014, are set forth below. All of the nominees have been nominated by

theour Board acting on the recommendation of the Nominating and Corporate Governance Committee of

theour Board, which consists solely of independent members of

theour Board.

The Board recommends that stockholders vote “For” the election of each of the following nominees.

Nominee | | Age | | Director

Since | | Principal Occupation |

Christopher R. Gardner | | 51 | | 2006 | | President and Chief Executive Officer of Vitesse |

| | | | | | |

Steven P. Hanson(1)(2) | | 63 | | 2007 | | Retired President and CEO of ON Semiconductor |

| | | | | | |

James H. Hugar(1)(2) | | 65 | | 2009 | | Retired Partner of Deloitte & Touche, LLP |

| | | | | | |

G. William LaRosa(2)(3) | | 65 | | 2010 | | Chief Executive Officer of G.W. LaRosa & Associates, LLC |

| | | | | | |

G. Grant Lyon(3) | | 48 | | 2009 | | President of Odyssey Capital Group, LLC |

| | | | | | |

Edward Rogas, Jr.(1)(3) | | 71 | | 2006 | | Chairman of the Board of Vitesse, Retired Senior Vice President of Teradyne, Inc. |

|

| | | | | | |

| Nominee | | Age | | Director

Since | | Principal Occupation |

| Matthew B. Frey (2) | | 45 | | 2013 | | Chief Executive Officer of Optimum Energy, LLC |

| Christopher R. Gardner | | 54 | | 2006 | | President and Chief Executive Officer of Vitesse |

| Steven P. Hanson(2)(4) | | 66 | | 2007 | | Retired President and CEO of ON Semiconductor |

| James H. Hugar (1)(3) | | 68 | | 2009 | | Retired Partner of Deloitte & Touche, LLP |

| Scot B. Jarvis (1)(3) | | 54 | | 2012 | | Co-founder of Cedar Grove Partners, LLC |

| William C. Martin (2)(4) | | 37 | | 2014 | | Chairman and Chief Investment Officer, Raging Capital Management, LLC |

| Edward Rogas, Jr. (1)(2) | | 74 | | 2006 | | Chairman of the Board of Vitesse, Retired Senior Vice President of Teradyne, Inc. |

| Kenneth H. Traub(3)(4) | | 53 | | 2013 | | President and CEO of Ethos Management, LLC |

(1) Member of the Audit Committee

(2) Member of the Nominating and Corporate Governance Committee

(3) Member of the Compensation Committee

| |

| (1) | Member of the Audit Committee |

| |

| (2) | Member of the Nominating and Corporate Governance Committee |

| |

| (3) | Member of the Compensation Committee |

| |

| (4) | Member of the Strategic Advisory Committee |

If a quorum is present, the

sixeight nominees receiving the highest number of votes will be elected to

theour Board. See “Information Concerning Solicitation and

Voting—Quorum,Voting-Quorum, Abstentions, Broker Non-Votes, Required Votes.”

5

Directors’Nominees’ Principal Occupation, Business Experience and Qualifications

Matthew B. Frey has served as a director since March 2013. He is the Chief Executive Officer of Optimum Energy, LLC, a cloud based SaaS provider of energy management applications for complex buildings, data centers, campuses, hospitals, and manufacturing facilities, a position he has held since November 2010. For more than 17 years, Mr. Frey has served in senior executive and advisory roles at technology companies, including Data Base, Inc., Payroll Online, World Wide Packets, and Optimum Energy. Prior to his current position at Optimum Energy, from January 2004 until its sale to Ciena Corporation in March of 2008, Mr. Frey served as President and Chief Operating Officer of World Wide Packets, a leading provider of Carrier Ethernet solutions. Subsequent to the sale, Mr. Frey served as Ciena’s Sr. Vice President of Business Development until January 2009. Mr. Frey brings operational, strategic, industry, and software development expertise to the Board. Mr. Frey holds a BS degree in accounting from Santa Clara University and worked as an auditor at Price Waterhouse in Silicon Valley early in his career.

Christopher R. Gardner has served as a director and our Chief Executive Officer since 2006. From 2002 until he was appointed Chief Executive Officer in 2006, he served as our Vice President and General Manager of the Network Products Division, and from 2000 to 2002, he served as our Vice President and Chief Operating Officer. Prior to joining Vitesse in 1986, Mr. Gardner served as a member of the Technical Staff at Bell Laboratories. Mr. Gardner’s extensive career in the semiconductor industry, combined with his extensivebroad knowledge and understanding of our Company, the industry and the markets in which we operate, and the issues facing the Company, make Mr. Gardner a valuable member of our Board. Mr. Gardner received his BSEE degree from Cornell University and his MSEE degree from the University of California at Berkeley.

Steven P. Hansonhas served as a director since August 2007. For more than 32 years, Mr. Hanson has served in senior executive roles at technology companies, including 28 years at Motorola in various engineering management and leadership positions. Mr. Hanson served as the President and Chief Executive Officer of ON Semiconductor from 1999 to 2003. Mr. Hanson has been a senior partner at Southwest Value Acquisitions LLC, a private equity firm, since 2004. He served as the Chairman of InPlay Technologies, Inc., a high-technology firm delivering leadership human input device technologies and products from 2005 to 2007. Mr. Hanson has served Arizona State University as a member of the Dean’s Advisory Council, W.P. Carey School of Business and the Dean’s Advisory Council for the Ira A. Fulton School of Engineering. As a former senior executive at technology companies including ON Semiconductor and the General Manager of Europe, Middle East and Africa Semiconductor Group of Motorola, Mr. Hanson brings operational, strategic and industry expertise to our Board. Mr. Hanson holds a BSEE degree from the College of Engineering at Arizona State University.

James H. Hugar has served as a director since October 2009. Mr. Hugar retired from Deloitte & Touche, LLP, where he was an audit partner from 1982 to 2008, specializing in the financial services industry. Prior to his retirement, he served as the partner-in-charge of the Southern California Investment Companies Industry and Broker/Dealer Practice Unit. Mr. Hugar serves on the Board of Advisors of American Relocation & Logistics, Inc., a privately-held company. With over 35 years of experience in public accounting, including participation at hundreds of audit committee meetings and serving as a director/advisor for both privately and publicly held companies, Mr. Hugar brings public company financial expertise to theour Board. Mr. Hugar holds a BS degree in Accounting from Pennsylvania State University and an MSBA degree from the University of California, Los Angeles, and is a Certified Public Accountant.

G. Scot B. Jarvis has served as a director since May 2012. Mr. Jarvis co-founded Cedar Grove Partners, LLC, an investment and consulting/advisory partnership with a focus on wireless communication investments in 1997, and currently is its managing member. While at Cedar Grove, he has invested in several successful early-stage companies in the telecommunications area and has served on a number of public and private boards. Prior to co-founding Cedar Grove, Mr. Jarvis served as a senior executive of Eagle River, Inc., a Craig McCaw investment firm. While at Eagle River, he founded Nextlink Communications (now XO Communications) on behalf of McCaw and served on its board of directors. Mr. Jarvis has also served on the board of directors of Nextel Communications and Leap Wireless International. From 1985 to 1994, Mr. Jarvis served in several executive capacities at McCaw Cellular Communications up until it was sold to AT&T. Mr. Jarvis currently serves on the board of Kratos Defense & Security Solutions (NASDAQ: KTOS) and Airspan Networks Inc. (OTCMKTS: AIRO), both publicly traded companies. In addition, Mr. Jarvis currently serves on the board of directors of Good Technology, Inc., Root Wireless, Inc., MobiTV, Inc., and Slingshot Sports, LLC, all private companies. He is a venture partner with Oak Investment Partners, a venture capital firm. Mr. Jarvis brings to our Board extensive experience in the technology industry and public company board experience. Mr. Jarvis holds a BA degree in business administration from the University of Washington.

William LaRosaC. Martin has served as a director since August 2010.2014. Mr. LaRosaMartin is currently theChairman and Chief ExecutiveInvestment Officer of G.W. LaRosa & Associates,Raging Capital Management, LLC, a global technology sales and business development firm,private investment partnership based near Princeton, New Jersey that was founded in 2006. Mr. Martin has co-founded a position he has held since June 2009. Mr. LaRosa founded Lead Group International (LGI) and helped lead smaller technologynumber of financial information companies, including Silicon GraphicsRagingBull.com in 1997 and American Motion Systems. Mr. LaRosa currently servesInsiderScore.com in 2004. He has also served on two public company boards, including nine years on the board of advisors for Silvatron PartnersBankrate, Inc., which was acquired in Los Gatos, California. Mr. La Rosa also currently serves as a group chairman of Visage International, a global CEO organization. He is a past director for the advisory board for the Lubin School of Business at PACE University,2009, and a CEO and former chairman of the board at LGI. Theof Salary.com, Inc., which was acquired in 2010. Mr. Martin’s extensive experience he gained over the 30 years of holding various senior level, VP and senior executive positions at industry leading companies including General Electric, IBM and Advanced Micro Devices allows Mr. LaRosa to provide the Board with industry experiencesuccessful track record as an investor, entrepreneur and public company sales, marketing and operational expertise. Mr. LaRosa earneddirector, coupled with his MBA degree from the Lubin School of Business at PACE University and has a BS degreesignificant financial stake in electrical and electronic engineering from Manhattan College in New York City.6

G. Grant Lyon has served as a director since October 2009. Mr. Lyon is currently the President of Odyssey Capital Group, LLC, a financial advisoryour company, will enable him to provide Vitesse’s Board and management consulting firm, where he has been employed since 1998. In 2005, he served as interim Chief Financial Officer of Hypercom Corporation. Priorwith valuable perspectives on executing strategies to 2005, Mr. Lyon held positions as managing director at Ernst & Young Corporate Finance, LLC, and a managing member of Golf Equity, LLC and Vice President, Capital Markets at Evans Withycombe Residential, Inc. Mr. Lyon began his career at Arthur Andersen, LLP, where he worked from 1987 to 1989. Mr. Lyon served as Chairman of the Board of Three Five Systems. He has also served as a director of Tickets.com, Inc. Mr. Lyon’s breadth of experience in corporate finance and strategic initiatives, including capital raising, business and securities valuation, mergers and acquisitions and bankruptcy reorganizations allows Mr. Lyon to provide guidance to our Board and our Company regarding our operations, growth strategies and opportunities. Mr. Lyon holds a BS degree and an MBA degree from Brigham Young University. Mr. Lyon is a Certified Public Accountant and a published author and speaker.maximize stockholder value.

Edward Rogas, Jr. has served as a director and Chairman of theour Board since 2006. Mr. Rogas is a director and consultant to companies in the technology industry. He served as a Senior Vice President at Teradyne, Inc., an automated test equipment manufacturer, from 2000 to 2005. From 1976 to 2000, he held various management positions in the semiconductor ATE portion of Teradyne, Inc., including Vice President from 1984 to 2000. From 1973 to 1976, he served as a Vice President at American Research and Development. Mr. Rogas serves on the Board of FormFactor, Inc., a manufacturing test-technology company, and Vignani Technologies, Pvt. Ltd. (a private Indian company).company. Mr. Rogas previously served on the board of directors of Photon Dynamics, Inc., a provider of digital imaging technology.LCD panel testers. Mr. Rogas brings to our Board extensive experience in engineering development and operations in the technology industry, financial sophistication and public company board experience. Mr. Rogas holds a BS degree from the United States Naval Academy and an MBA degree from Harvard Business School.

Kenneth H. Traub has served as a director since March 2013. Heis the President and Chief Executive Officer of Ethos Management LLC, a position he has held since January 2009, and he has served as general partner of Rosemark Capital LLC, a private equity firm, since September 2013. From 1999 until its acquisition by JDS Uniphase Corp. (“JDSU”) in February 2008, he served as President and Chief Executive Officer of American Bank Note Holographics, Inc. (“ABNH”), a leading global supplier of optical security devices. Mr. Traub managed the turnaround, growth and sale of ABNH, and under his leadership, ABNH’s stockholders achieved a gain exceeding 1,000 percent. Following the sale of ABNH, he served as Vice President of JDSU, a global leader in optical technologies and telecommunications, through September 2008. In 1994, Mr. Traub co-founded Voxware, Inc., a pioneer in voice over Internet protocol communication technologies, and served as its Executive Vice President and Chief Financial Officer through 1998. From 1988 to 1994, he served as Vice President of Trans-Resources, Inc., a multinational holding company and investment manager. Mr. Traub currently serves on the boards of directors of (i) MRV Communications, Inc. (NASDAQ: MRVC) (Mr. Traub is currently Chairman of the Board), (ii) DSP Group, Inc. (NASDAQ: DSPG), and (iii) Athersys, Inc. (NASDAQ: ATHX). He previously served on the Boards of Directors of (i) Phoenix Technologies, Inc. (NASDAQ: PTEC) from November 2009 until its sale in November 2010, (ii) iPass, Inc. (NASDAQ: IPAS) from June 2009 to June 2013, (iii) MIPS Technologies, Inc. (NASDAQ: MIPS) from November 2011 until its sale in February 2013, and (iv) Xyratex Limited (NASDAQ: XRTX) from June 2013 until its sale in March 2014. He also served as the Chairman of the Board of the New Jersey chapter of the Young Presidents Organization in 2010 and 2011. He received a BA degree from Emory College, and an MBA from Harvard Business School. Mr. Traub has over 20 years of senior management, corporate governance, turnaround and transactional experience with various public and private companies. His wealth of executive management and board experience and corporate governance awareness from his experience as a senior executive of public companies and his current and past service as a director allow him to provide valuable advice and guidance to our Board.

The Board has determined that all of its current members

and the nominees for election at the Annual Meeting, other than Mr. Gardner, meet the criteria for independence set forth in the NASDAQ Listing Rules and the Company’s Corporate Governance Guidelines. Mr. Gardner does not qualify as independent because

hishe is a Vitesse employee. Our Corporate Governance Guidelines are posted on our website at www.vitesse.com under “Investors

—- Corporate Governance.”

In making its determination, our Board considered the objective tests and the subjective tests for determining who is an “independent director” under the NASDAQ Listing Rules. The subjective test states that an independent director must be a person who lacks a relationship that, in the opinion of our Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In assessing independence under the subjective test, our Board took into account the standards in the objective tests, and reviewed and discussed additional information provided by the directors and the Company with regard to each director’s business and personal activities as they may relate to us and our management for the three year period preceding the date of determination. determination, including the following:

the circumstances leading to Messrs. Frey and Traub’s nominations for election to the Board at the 2013 Annual Meeting, which occurred at the request of Raging Capital Fund, LP, the predecessor in-interest of Raging Capital Master Fund, Ltd. (“the Fund”);

Mr. Martin’s position as Chairman and Chief Investment Officer of the Fund, and the Fund’s ownership of approximately 20.9% of Vitesse’s voting securities; and

the Fund’s compensation of Mr. Traub for his service on the Board as disclosed in the Fund’s filings with the SEC, including (i) the payment to Mr. Traub of $15,000 in cash upon his nomination to the Board in November 2012 to be used to acquire our securities, (ii) the payment to Mr. Traub at the end of calendar 2013, 2014 and 2015 (or earlier upon a sale of the company), so long as Mr. Traub is a director at such time, of an amount equal to 7.5% of any actual net profits (as defined in Mr. Traub’s compensation agreement with the Fund) realized by the Fund with respect to its investment in our securities (including our convertible debentures) for the applicable calendar year, and (iii) if the Fund continues to own our securities as of the end of calendar 2015, the payment to Mr. Traub at the end of calendar year 2015, so long as Mr. Traub is a director at such time, of an amount equal to 7.5% of the unrealized net profits of the Fund with respect to its investment in our securities as of the end of such year.

Based on all of the foregoing, as required by NASDAQ rules, our Board made a subjective determination as to each independent director that no relationships

existsexist which, in the opinion of our Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

The Board and Board Committees

The Board held a total of

nineeight meetings during fiscal year

2011.2014. Each of our incumbent directors attended at least 75 percent of the aggregate of all meetings of

theour Board and the committees of

theour Board upon which such director served in fiscal year

2011.2014. Under our Corporate Governance Guidelines,

theour Board is required to hold an executive session at each meeting of

theour Board at which employee directors are not present.

The

Our Board has been chaired by Mr. Rogas since December 2006. As chairman of

theour Board, Mr. Rogas also serves as our Lead Director. The Board has elected to maintain a leadership structure with an independent director chairman, elected by vote of the independent directors, because we believe that, at this time, our Company and its stockholders are best served by having an independent chairman convene, establish, after consultation with management,

set agenda items for, and preside over meetings of

theour Board and executive sessions of the independent directors. We further believe that our corporate governance principles and policies ensure that strong and independent directors will continue to effectively oversee our management and key issues related to long-range business plans, strategic issues, risks, and integrity.

During fiscal year

2011, the2014, our Board had three standing committees: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee.

Our Board also has continuously maintained since fiscal year 2012 a Strategic Advisory Committee as an ad hoc committee of our Board with an indefinite term.

The Audit Committee, which consists of Messrs. Hugar,

HansonJarvis and Rogas, has been chaired by Mr. Hugar since December

9, 2009. All of the members of the Audit Committee are “independent” as defined under rules promulgated by the SEC and meet the NASDAQ Listing Rules criteria for independence.

TheOur Board has determined that Mr. Hugar is an “audit committee financial expert” as that term is defined in Item 407(d)(5) of Regulation S-K. Among other things, the Audit Committee assists our Board of Directors in its oversight of the integrity of our financial statements, the qualifications and independence of our independent auditors, the performance of our internal audit function, compliance with legal and regulatory requirements, our disclosure controls, and our systems of internal controls. The Audit Committee held

ninesix meetings during fiscal year

2011.2014. A copy of the Audit Committee charter is available on our website at www.vitesse.com under “Investors

—- Corporate Governance.”

The Compensation Committee, which consists of Messrs.

Lyon, LaRosaHugar, Jarvis and

Rogas,Traub, has been chaired by Mr.

LyonJarvis since

December 9, 2009. Mr. Lyon and Mr. Rogas have served on this committee since December 9, 2009, and Mr. LaRosa has served on this committee since August 11, 2010.March 2013. The Compensation Committee, among other things, reviews and approves our executive compensation policies and programs, and grants stock options and other equity awards to our employees, including officers, pursuant to our stock incentive plans. See

“Executive Officers and Executive Compensation—Compensation“Compensation Discussion and Analysis” and

“Director“Proposal One - Election of Directors - Director Compensation” below for a description of our processes and procedures for the consideration and determination of executive and director compensation. The Compensation Committee held

eightfive meetings during fiscal year

2011.2014. A copy of the Compensation Committee charter is available on our website at www.vitesse.com under “Investors

—- Corporate Governance.”

8

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee, which consists of Messrs.

Frey, Hanson,

HugarMartin, and

LaRosa,Rogas, has been chaired by Mr. Hanson since June

29, 2009.

Mr. Hugar has served on this committee since December 9, 2009 and Mr. LaRosa has served on this committee since August 11, 2010. The Nominating and Corporate Governance Committee, among other things, assists

theour Board by making recommendations to

theour Board on matters concerning director nominations and elections, board committees and corporate governance. The Nominating and Corporate Governance Committee held four meetings during fiscal year

2011.2014. A copy of the Nominating and Corporate Governance Committee charter is available on our website at www.vitesse.com under “Investors

—- Corporate Governance.”

Strategic Advisory Committee

The Board forms ad hoc committees from time-to-time to assist our Board in fulfilling its responsibilities with respect to matters that are the subject of the ad hoc committee’s mandate. During fiscal year 2014, the Board maintained a Strategic Advisory Committee that was originally formed in fiscal year 2012 to assist our Board by making recommendations on transactions and initiatives that the committee believes are reasonably likely to maximize stockholder value. During fiscal year 2014, the Strategic Advisory Committee was chaired by Mr. Rogas and consisted of Messrs. Frey, Hanson, Hugar, Jarvis, Rogas, and Traub. In October 2014, the size of the Strategic Advisory Committee was reduced to three members, and currently consists of Messrs Hanson, Martin and Traub, with Mr. Traub serving as chair of the committee.

Corporate Governance Guidelines

The Company maintains a set of Corporate Governance Guidelines, which can be found on our website at www.vitesse.com under “Investors

—- Corporate Governance.” The Corporate Governance Guidelines cover a range of governance related matters, including requirements that

theour Board maintain an independent Chairman of the Board, and that at least three fourths of

theour Board

andas well as the Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee consist of independent members.

The Corporate Governance Guidelines also provide that no director may serve on the board of more than three other public companies while serving on Vitesse’s Board. Our Board waived this guideline with respect to Mr. Traub, who presently serves on the board of four other public companies.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics for members of

theour Board, our Chief Executive Officer, Chief Financial Officer, Chief Accounting Officer and Controller and persons performing similar functions, and all other officers and employees of the Company and its consolidated subsidiaries. A copy of this Code is posted on our website at www.vitesse.com under “Investors

—- Corporate Governance.” We intend to disclose any amendment to, or waiver from, the provisions of this Code on our website at www.vitesse.com under “Investors

—- Corporate Governance.”

Board’s Role in Risk Oversight

Our management team is responsible for identifying, assessing and managing the material risks facing our Company.

TheOur Board’s role in risk oversight includes receiving regular updates from management on areas of material risks and key strategies and initiatives.

TheOur Board also participates in a review of the Company’s annual operating plan, which includes the identification of the most significant risks facing our business and evaluation of how the Company’s corporate strategies align to manage those risks. While

theour Board is ultimately responsible for risk oversight, each committee assists

theour Board in fulfilling its oversight responsibilities. The Audit Committee oversees management of financial risks. The Compensation Committee provides oversight of the Company’s compensation policies and practices including risks associated with executive compensation. The Nominating and Corporate Governance Committee manages risks associated with corporate governance, including the independence of Board members, Board composition, and policies and procedures such as our Code of Business Conduct and Ethics and Corporate Governance Guidelines, used to promote ethical conduct and compliance with law.

The full Board has evaluated Vitesse’s overall compensation policies and practices for its employees to determine whether such policies and practices create incentives that can affect Vitesse’s risk and management of that risk, and has further assessed whether any risks arising from these policies and practices are reasonably likely to have a material adverse effect on us.

TheOur Board has concluded that the risks arising from our policies and practices are not reasonably likely to have a material adverse effect on us.

9

The Compensation Committee and theour Board, in connection with their assessment of performance criteria for fiscal year 2011,2014, concluded that while the criteria or targets reward prudent risk-taking in support of our objectives, they do not encourage or promote inappropriate risk-taking by the participants.

Attendance at Annual Meeting

of Stockholders by Directors

It is the policy of the Company that, absent extraordinary circumstances, each member of

theour Board shall attend our Annual Meeting of Stockholders. All of our Board members attended the last year’s Annual

Meeting.Meeting of Stockholders.

Compensation Committee Interlocks and Insider Participation

During

Messrs. Hugar, Jarvis and Traub were members of the Compensation Committee during fiscal year

2011, G. Grant Lyon, G. William LaRosa and Edward Rogas, Jr. served on the Compensation Committee.2014. None of the committee members has ever served as an officer of Vitesse. None of the committee members served as an employee of Vitesse during fiscal year

20112014 or had any relationship requiring disclosure by us under Item 404 of Regulation S-K. During fiscal year

2011,2014, none of our executive officers served on the compensation committee (or equivalent), or the board of directors, of another entity whose executive officer(s) served on our Compensation Committee or Board of Directors.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our executive officers, directors, and persons who own beneficially more than 10 percent of a registered class of our equity securities to file reports of ownership and changes in ownership within specified periods with the SEC. To our knowledge, based solely on our review of the copies of Section 16(a) forms required to be furnished to us with respect to fiscal year

20112014 and written representations that no other reports were required, we believe that our executive officers, directors, and greater than 10 percent stockholders complied with the Section 16(a) reporting requirements during fiscal year

2011, except as follows: Columbia Pacific Opportunity Fund, L.P., Columbia Pacific Advisors, LLC, Alexander B. Washburn, Daniel R. Baty, Stanley L. Baty and Brandon D. Baty jointly filed a Schedule 13G/A with the SEC on June 10, 2011, in which they reported beneficial ownership of 11.2 percent of our Common Stock. None of these beneficial owners of greater than 10% of our common stock has filed a Form 3 with the SEC.2014.

Process for Recommending Candidates for Election to

theour Board of Directors

The Nominating and Corporate Governance Committee will consider nominees recommended by stockholders. A stockholder that desires to recommend a candidate for election to

theour Board must direct the recommendation in writing to us at our principal offices (Attention: Corporate Secretary) and must include the candidate’s name, age, home and business contact information, principal occupation or employment, the number of shares beneficially owned by the nominee, whether any hedging transactions have been entered into by the nominee or on his or her behalf, information regarding any arrangements or understandings between the nominee and the stockholder nominating the nominee or any other persons relating to the nomination, a written statement by the nominee acknowledging that the nominee will owe a fiduciary duty to the Company, if elected, and any other information required to be disclosed about the nominee if proxies were to be solicited to elect the nominee as a director. For a stockholder recommendation to be considered by the Nominating and Corporate Governance Committee as a potential candidate at an Annual Meeting, nominations must be received on or before the deadline for receipt of stockholder proposals for such meeting. In the event a stockholder decides to nominate a candidate for director and solicits proxies for such candidate, the stockholder will need to follow the rules set forth by the SEC and in our bylaws. See “Information Concerning Solicitation and Voting

-− Deadline for Receipt of Stockholder Proposals.”

10

The Nominating and Corporate Governance Committee’s criteria and process for evaluating and identifying the candidates that it approves as director nominees are as follows:

·

The committee regularly reviews the current composition and size of

theour Board.

·

The committee reviews the qualifications of any candidates who have been properly recommended by a stockholder, as well as those candidates who have been identified by management, individual members of

theour Board or, if the committee determines, a search firm. Such review may, in the committee’s discretion, include a review solely of information provided to the committee or may also include discussions with persons familiar with the candidate, an interview with the candidate or other actions that the committee deems proper.

·

The committee evaluates the performance of

theour Board as a whole and evaluates the performance and qualifications of individual members of

theour Board eligible for re-election at an Annual Meeting of Stockholders.

·

The committee considers the suitability of each candidate, including the current members of

theour Board, in light of the current size and composition of

theour Board. Except as may be required by rules promulgated by the NASDAQ Stock Market or the SEC, it is the committee’s belief that there are no specific minimum qualifications that must be met by any candidate for

theour Board, nor are there specific qualities or skills that are necessary for one or more of the members of

theour Board to possess. In selecting new directors of the Company, consideration will be given to each individual director’s (i) personal qualities, experiences, and abilities; (ii) the collective skills of all of the directors, taking into account the responsibilities of

theour Board; and (iii) qualifications imposed by law and regulation. As stated in the Company’s Corporate Governance Guidelines, the Company has the following expectations of its directors and director candidates:

·

Directors should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of the stockholders;

·

Directors must have an inquisitive and objective perspective, practical wisdom and mature judgment;

·

Directors should represent diverse experiences at a strategy/policy setting level, and should be people who have high-level managerial experience, and who are accustomed to dealing with complex problems;

·

Directors must be willing to devote sufficient time to carrying out their duties and responsibilities effectively, and should be committed to serve on

theour Board for an extended period of time;

·

Directors should possess a willingness to challenge and stimulate management and demonstrate the ability to work as part of a team in an environment of trust; and

·

Directors should offer their resignation in the event of any significant change in their personal circumstances, including a change in their principal job responsibilities.

11

·The committee may, from time-to-time, establish additional qualifications for directors as it deems appropriate.

·

In evaluating the qualifications of the candidates, the committee considers many factors, including, issues of character, judgment, independence, age, expertise, diversity of experience, length of service, other commitments, and the like. However,

theour Board has not adopted a formal diversity policy. The committee evaluates such factors, among others, and does not assign any particular weighting or priority to any of these factors. The committee considers each individual candidate in the context of the current perceived needs of

theour Board as a whole.

·

After such review and consideration, the committee recommends the slate of

Directordirector nominees to the full Board for its approval.

The Nominating and Corporate Governance Committee will endeavor to notify, or cause to be notified, all

Directordirector candidates, including those recommended by a stockholder, of its decision as to whether to nominate such individual for election to

theour Board.

Stockholder Communication with

theour Board of Directors

Any stockholder may contact any of our

Directorsdirectors by writing to them by mail, c/o our Corporate Secretary, at our principal executive offices, the address of which appears on the cover of this proxy statement.

Any stockholder may report to us any complaints regarding accounting, internal accounting controls or auditing matters. Any stockholder who wishes to so contact us should send such comments to the Audit Committee, c/o James H. Hugar, at our principal executive offices, the address of which appears on the cover of this proxy statement.

Any stockholder communications sent to

theour Board will first go to our Corporate Secretary, who will log the date of receipt of the communication as well as the identity and contact information of the correspondent in our stockholder communications log. After logging the communication, our Corporate Secretary will forward the communication to the Chairman of

theour Board (in the case of communications directed to the whole Board) or to the applicable individual

Director(s)director(s) addressed in the correspondence.

In the case of any complaints, the appropriate committee of

theour Board will review and, if appropriate, investigate the complaint in a timely manner. In the case of accounting or auditing related matters, a member of the Audit Committee, or the Audit Committee as a whole, will review the summary of the communication, the results of the investigation, if any, and, if appropriate, the draft response. The summary and response will be in the form of a memo, which will become part of the stockholder communications log that the Corporate Secretary maintains with respect to all stockholder communications.

12

The general policy of

theour Board is that compensation for non-employee directors should be a mix of cash and equity-based compensation. We do not pay management

Directorsdirectors for Board service in addition to their regular employee compensation. The Compensation Committee, which consists solely of independent directors, has the primary responsibility for reviewing and considering any revisions to director compensation. Our Board reviews the Compensation Committee’s recommendations and determines the amount and type of director compensation.

The Compensation Committee can engage the services of outside advisers, experts and others to assist the committee. During fiscal year

2011,2014, the Compensation Committee

did not use an outside adviser to assist in setting director compensation. The fiscal year 2011 compensation package for Directors is the same as the fiscal year 2010 compensation package for Directors, which was adopted on April 1, 2010, after consultation withengaged independent compensation consultant,

Connell & Partners, a divisionRadford, an Aon Hewitt Company, to review director compensation and make recommendations to the Compensation Committee for changes in director compensation for fiscal year 2015. Effective October 1, 2014, on the recommendation of

Gallagher Benefit Services (formerly DolmatConnell & Partners).the Compensation Committee, our Board of Directors modified the equity compensation payable to non-employee directors to increase to 16,500 the annual number of restricted stock units, or RSUs, awarded to non-employee directors and eliminate the annual number of RSUs awarded to non-employee directors serving on the Strategic Advisory Committee. Prior to this change, non-employee directors received an annual award of 9,500 RSUs for service on the Board and an annual award of 4,000 RSUs for service on the Strategic Advisory Committee. No changes were made to the cash compensation payable to non-employee directors.

Non-employee director compensation consists of the following elements:

·

Annual retainer of

$30,000;·$40,000;

Chairperson of the Board

—− additional retainer fee of

$20,000;·$25,000;

Committee chairpersons

—− additional retainer fees of $20,000 for the Audit Committee,

$12,000$15,000 for the Compensation Committee, and

$8,000$10,000 for the Nominating and Corporate Governance Committee;

·

Committee membership (excluding chairpersons)

—− additional retainer fees of

$8,000$10,000 for the Audit Committee,

$6,000$8,000 for the Compensation Committee, and

$4,000$5,000 for the Nominating and Corporate Governance Committee;

·Board meeting fees — $1,500 for attendance at each in-person Board meeting and $750 for attendance at each scheduled conference call Board meeting;

·Committee meeting fees —$1,000 for attendance at each in-person committee meeting and $500 for attendance at each scheduled conference call committee meeting; and

·

Annual equity compensation $55,000 in the form of restricted stock units (RSUs),16,500 RSUs, which RSUs are automatically granted on the second Monday in January of the applicable year and vest fully on the first anniversary of the grant date; and

Strategic Advisory Committee membership fees − $1,000 for attendance at each in-person meeting and $500 for attendance at each scheduled conference call meeting.

A non-employee director also is entitled to receive, upon initial election or appointment to our Board, a one-time award of equity compensation of 14,000 RSUs to be granted on the date of the director’s appointment or election to our Board and to vest in three annual installments of 33% on the first three anniversaries of the grant date.

If a non-employee

Directordirector is appointed to

theour Board in between Annual Meetings of Stockholders, the annual cash compensation payable to that

Directordirector is pro-rated for the remaining portion of the term in which the director is appointed to

theour Board, and the first award of

$55,000 in annual equity compensation to be automatically granted to the director on the second Monday in January of the year following the

Director’sdirector’s appointment is pro-rated based on the length of the

Director’sdirector’s service on

theour Board since the date of the previous year’s annual award of equity compensation.

Upon a non-employee Director’s initial election or appointment to

Our Board may provide for payment of per meeting cash fees and award additional equity for service on ad hoc committees of our Board established from time-to-time, and currently pays such fees for service on the

Strategic Advisory Committee. Our Board

the director also

receives a one-time award of equity compensation of $100,000 in the formauthorized an additional grant of RSUs

which RSUs are grantedfor service on the

date of the Director’s appointment or election to the Board and vest in three annual installments of 33% on the first three anniversaries of the grant date.13

Strategic Advisory Committee during fiscal year 2014.

The following table details the total compensation earned by our non-employee Directorsdirectors in fiscal year 2011.

2014.

Director Summary CompensationDirector | | Fees Earned

or Paid in

Cash | | Stock

Awards(1)(2) | | Total | |

| | | | | | | |

Steven P. Hanson (3)(8) | | $ | 67,746 | | $ | 55,000 | | $ | 122,746 | |

James H. Hugar (4)(8) | | $ | 75,750 | | $ | 55,000 | | $ | 130,750 | |

G. William LaRosa (5)(8) | | $ | 58,246 | | $ | 22,916 | | $ | 81,162 | |

G. Grant Lyon (6)(8) | | $ | 53,750 | | $ | 55,000 | | $ | 108,750 | |

Edward Rogas, Jr. (7)(8) | | $ | 86,746 | | $ | 55,000 | | $ | 141,746 | |

|

| | | | | | | | | | | | |

| Director | | Fees Earned

or Paid in

Cash | | Stock

Awards(1)(2)(3) | | Total |

| Matthew B. Frey (4) | | $ | 48,000 |

| | $ | 39,971 |

| | $ | 87,971 |

|

| Steven P. Hanson (5) | | 53,000 |

| | 43,605 |

| | 96,605 |

|

| James H. Hugar (6) | | 71,000 |

| | 43,605 |

| | 114,605 |

|

| Scot B. Jarvis (7) | | 68,000 |

| | 43,605 |

| | 111,605 |

|

| William C. Martin (8) | | — |

| | — |

| | — |

|

| Edward Rogas, Jr. (9) | | 83,000 |

| | 43,605 |

| | 126,605 |

|

| Kenneth H. Traub (10) | | 51,000 |

| | 39,971 |

| | 90,971 |

|

| | | $ | 374,000 |

| | $ | 254,362 |

| | $ | 628,362 |

|

(1)Represents awards of restricted stock units, each of which entitles the Director to receive one share of our Common Stock at the time of vesting, without the payment of an exercise price or other cash consideration.

(2)These amounts represent the grant date fair value of the stock awards granted in fiscal year 2011 determined in accordance with ASC Topic 718. These amounts may not correspond to the actual value eventually realized by the Director, | |

| (1) | Represents awards of restricted stock units, each of which entitles the director to receive one share of our Common Stock at the time of vesting, without the payment of an exercise price or other cash consideration. |

| |

| (2) | These amounts represent the grant date fair value of the stock awards granted in fiscal year 2014 determined in accordance with ASC Topic 718. These amounts may not correspond to the actual value eventually realized by the director, which depends in part on the market value of our Common Stock in future periods. Assumptions used in calculating these amounts are set forth in the Notes to Consolidated Financial Statements included in our annual report on Form 10-K for the year ended September 30, 2014. |

| |

| (3) | On January 13, 2014, each of Messrs. Hanson, Hugar, Jarvis and Rogas received an RSU award for 13,500 shares of Common Stock and Messrs. Frey and Traub received an RSU award for 12,375 shares of Common Stock, which RSU awards vest in full on the first anniversary of the date of grant. |

| |

| (4) | Mr. Frey served as a member of the Nominating and Corporate Governance Committee and Strategic Advisory Committee during fiscal year 2014. |

| |

| (5) | Mr. Hanson served as Chairman of the Nominating and Corporate Governance Committee and a member of the Strategic Advisory Committee during fiscal year 2014. |

| |

| (6) | Mr. Hugar served as Chairman of the Audit Committee and a member of the Compensation Committee and Strategic Advisory Committee during fiscal year 2014. |

| |

| (7) | Mr. Jarvis served as Chairman of the Compensation Committee and a member of the Audit Committee and Strategic Advisory Committee during fiscal year 2014. |

| |

| (8) | Mr. Martin joined the Board on August 20, 2014, and has elected not to receive any compensation for service on the Board or any of its committees. |

| |

| (9) | Mr. Rogas served as Chairman of our Board and Chairman of the Strategic Advisory Committee and as a member of the Audit Committee and Nominating and Corporate Governance Committee during fiscal year 2014. |

| |

| (10) | Mr. Traub served as a member of the Compensation Committee and Strategic Advisory Committee during fiscal year 2014. |

Stock Ownership Guidelines for Non-Employee Directors

The Board of Directors has established stock ownership guidelines for non-employee directors. Each non-employee director is expected to own Vitesse Common Stock-based holdings equal in value to at least three times such director’s annual cash retainer for service on our Board, excluding retainers and other amounts paid for service as Chairperson, Lead Director or on committees of our Board. Non-employee directors may count toward these guidelines the value of (i) shares they or their immediate family members own directly or in trust, including the vested portion of shares issued as restricted stock awards, and (ii) the vested portion of restricted stock units held by them and for which shares of Common Stock have not been issued, including shares that have not been issued due to a recipient’s election to defer the settlement date for such vested restricted stock units. Each non-employee director is expected to achieve this level of ownership by the later of August 9, 2015 or the third anniversary of his or her election to our Board of Directors.

The share ownership of the non-employee directors serving at September 30, 2014 is reported below, and is based on the closing market price of our Common Stock (which was $3.60 on September 30, 2014):

|

| | | | |

| Director | | Current Ownership Guideline as a Multiple of Annual Cash Retainer Fee | | Ownership as a Multiple of Annual Cash Retainer Fee as of September 30, 2014 |

| Matthew B. Frey | | 3 | | * |

| Steven P. Hanson | | 3 | | 7 |

| James H. Hugar | | 3 | | 8 |

| Scot B. Jarvis | | 3 | | 8 |

| William C. Martin | | 3 | | * |

| Edward Rogas, Jr. | | 3 | | 8 |

| Kenneth H. Traub | | 3 | | 9 |

* Less than 1.

PROPOSAL TWO

APPROVAL OF

2015 INCENTIVE PLAN

Proposal Two is approval of the Vitesse Semiconductor Corporation 2015 Incentive Plan (the “2015 Incentive Plan”). The proposal to approve the 2015 Incentive Plan requires the affirmative vote of a majority of the shares of Common Stock present or represented and entitled to vote at the Annual Meeting with respect to such proposal.

Our Board believes that the continued growth of Vitesse depends, in large part, upon its ability to attract and motivate key employees and directors, and that equity incentive awards are an important means of attracting, retaining and motivating talented employees and directors. Accordingly, we are seeking stockholder approval of the 2015 Incentive Plan. Our Board adopted the 2015 Incentive Plan, upon recommendation of our Compensation Committee, subject to stockholder approval at the Annual Meeting.

If the 2015 Incentive Plan is approved by stockholders, it will replace the Vitesse Semiconductor Corporation 2013 Incentive Plan, which we refer to in this proposal as the “Current Incentive Plan.” If stockholders approve the 2015 Incentive Plan, no new awards will be granted under the Current Incentive Plan. If stockholders do not approve the 2015 Incentive Plan, the Current Incentive Plan will remain available for new grants until it expires on January 14, 2023.

The 2015 Incentive Plan authorizes the issuance of a number of shares of our Common Stock equal to the sum of (i) 6,500,000 plus (ii) the number of shares of Common Stock that, immediately prior to stockholder approval of the 2015 Incentive Plan, remain available for issuance pursuant to new awards to be granted under the Current Incentive Plan. In addition to the new shares authorized for issuance under the 2015 Incentive Plan, the 2015 Incentive Plan also provides that shares subject to awards outstanding under the Current Incentive Plan, the 2010 Vitesse Semiconductor Corporation Incentive Plan (the “2010 Incentive Plan”) and the Vitesse Semiconductor Corporation 2001 Stock Incentive Plan (the “2001 Incentive Plan”) also may become available for issuance under the 2015 Incentive Plan to the extent that these shares cease to be subject to the awards (such as by expiration, cancellation or forfeiture of the awards). In the text of the 2015 Incentive Plan, we refer to the Current Incentive Plan, the 2010 Incentive Plan and the 2001 Incentive Plan as the “Prior Plans.” As of December 31, 2014, 783,948 shares were available for issuance under the Current Incentive Plan. No new awards will be made under the Current Incentive Plan following stockholder approval of the 2015 Incentive Plan. Our Board believes that these additional reserved shares are required in order for us to have an appropriate reserve of equity incentives to recruit, hire and retain the top talent that we will require to successfully execute our business strategy.

As of December 31, 2014, we had outstanding 68,426,192 shares of our Common Stock. If the 2015 Incentive Plan is approved by stockholders, the shares eligible for grant under the 2015 Incentive Plan will represent approximately 10.6% of our shares of Common Stock currently outstanding.

In addition to the new shares authorized for issuance under the 2015 Incentive Plan, shares subject to awards outstanding under the Prior Plans (of which there were 5,232,846 shares as of December 31, 2014) may become available for issuance under the 2015 Incentive Plan to the extent that these shares on or after the date of stockholder approval of the 2015 Incentive Plan, cease to be subject to the awards (such as by expiration, cancellation or forfeiture of the awards).

The principal features of the 2015 Incentive Plan are summarized below. This summary does not contain all information about the 2015 Incentive Plan. A copy of the complete text of the 2015 Incentive Plan is included as Annex A to this proxy statement, and the following description is qualified in its entirety by reference to the text of the 2015 Incentive Plan.

DESCRIPTION OF THE 2015 INCENTIVE PLAN

Purpose

The purpose of the 2015 Incentive Plan is to attract, retain and motivate our employees, officers and directors by providing them with the opportunity to acquire a proprietary interest in the Company and to align their interests and efforts to the long-term interests of our stockholders. The 2015 Incentive Plan also allows us to provide the same opportunity to consultants, agents, advisors, and independent contractors.

Administration

The Compensation Committee of our Board of Directors administers the 2015 Incentive Plan, except that our Board administers the 2015 Incentive Plan with respect to our non-employee directors. Our Board or the committee may delegate administration of the 2015 Incentive Plan in accordance with its terms. References to the “committee” in this Proposal Two are, as applicable, to the Compensation Committee, our Board or other delegate, including an officer of Vitesse authorized by our Board or Compensation Committee to make grants to certain eligible employees of Vitesse.

Eligibility

Awards may be granted under the 2015 Incentive Plan to employees, officers, directors, consultants, agents, advisors, and independent contractors of the Company and its subsidiaries and affiliates. As of December 31, 2014, approximately 230 employees and seven non-employee directors were eligible to receive awards under the 2015 Incentive Plan.

Number of Shares

The 2015 Incentive Plan authorizes the issuance of a number of shares of our Common Stock equal to the sum of (i) 6,500,000 plus (ii) the number of shares of Common Stock that, immediately prior to stockholder approval of the 2015 Incentive Plan, remain available for issuance pursuant to new awards to be granted under the Current Incentive Plan. In addition, shares subject to awards granted under the Prior Plans may again become available for awards under the 2015 Incentive Plan.